Lockwood Targeted Economic Development District

Meeting Schedule

Date: Third Wednesday of each month

Location: Zoot Training & Event Space (BSED Building, 201 N Broadway 2nd Floor) .

Time: 2:30 pm

The public is welcome.

Please email thom@bigskyeda.org if you have questions.

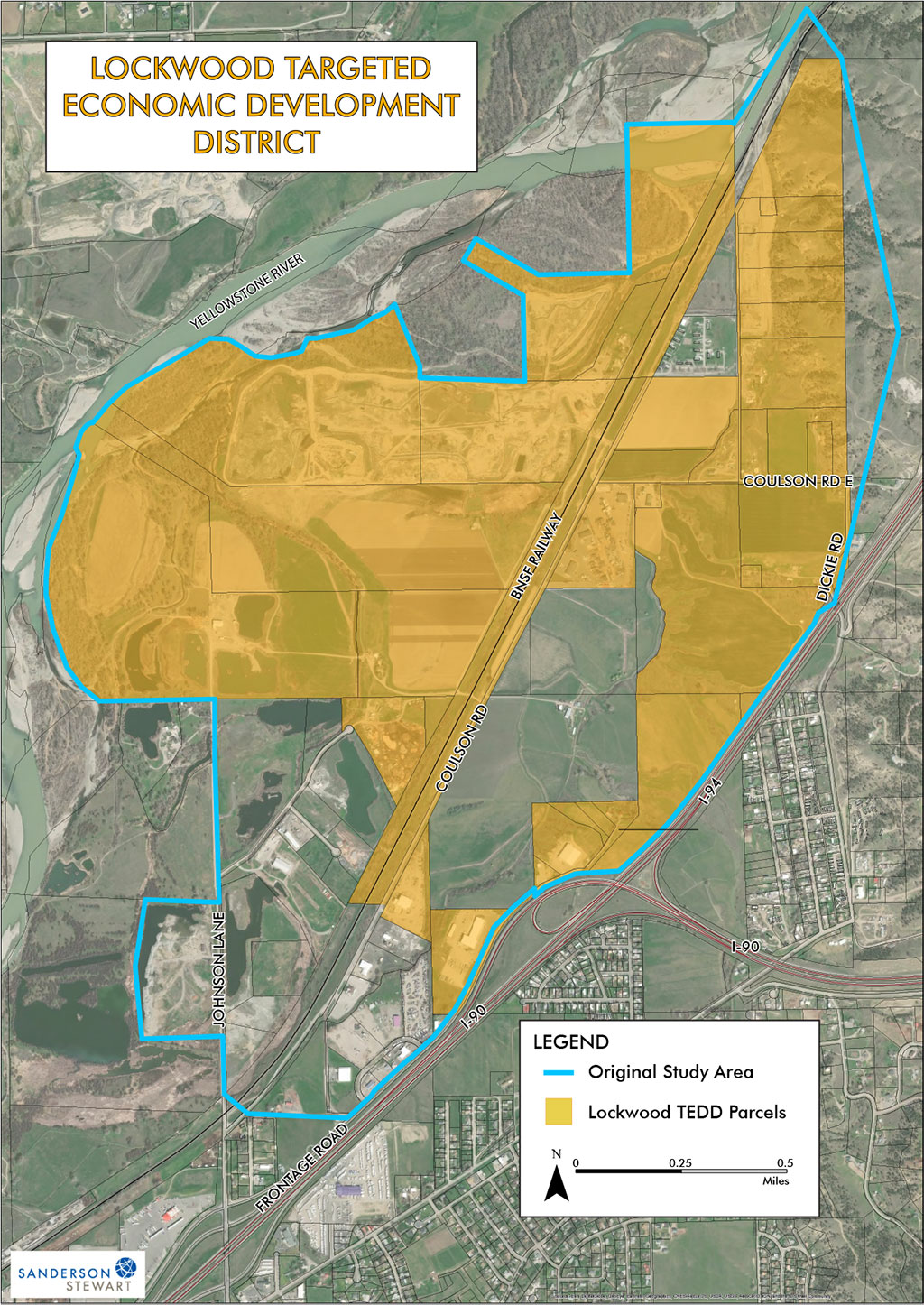

Yellowstone County established the Lockwood Targeted Economic Development District (TEDD) to help foster planned, ready-to-go industrial space. Located just east of Billings, the area offers over 1200 acres of land along the BNSF railroad and with easy access to the highway system from the Billings Bypass (currently under construction).

The Lockwood TEDD Advisory Board, Big Sky Economic Development, and the area property owners are working with Yellowstone County to plan and install the infrastructure needed to support industrial development, including:

- Extension of water and wastewater infrastructure throughout the area

- A road network to connect and serve planned development

- Additional rail sidings and spurs as needed, and

- Power and telecommunications services

Preliminary engineering for the initial water, wastewater, and road infrastructure investments is in progress, and the Montana Department of Transportation is expected to complete the Billings Bypass project by 2026. As these and other components fall into place, the Lockwood Industrial Area will be a huge catalyst for the economy of Yellowstone County, propelling the expansion of existing area businesses and facilitating the recruitment of new, value-adding industries to the region.

Lockwood TEDD Advisory Board

The Yellowstone County Commissioners created the Lockwood TEDD Advisory Board in March of 2018 and appointed members. The board is established to advise the Yellowstone County Commission in developing annual work plans, setting priorities and developing strategies for implementation of the recommendations in the Lockwood TEDD Strategic Plan and the Lockwood TEDD Infrastructure Master Plan.

TEDD Documents

Final TEDD Documents

TEDD Related Documents

Research / Pre-Development Activities

- Trailhead Commerce Park Economic Impact (BBER, 2015)

- Industrial Park Feasibility Analysis for Yellowstone County (KLJ, 2014)

- Trailhead Commerce Park Feasibility Study (LDI, 2013)

Yellowstone County Board of County Commissioners Documents Under Consideration

- None at this time

Yellowstone County Board of County Commission Action

Presentations to Yellowstone County Board of County Commissioners

- BSED and CDS of Montana PowerPoint Presentation of TEDD Phase I Scope of Work to the Commissioners During their January 12, 2015 Discussion Meeting

- BSED, CDS of Montana and Weave Management PowerPoint Presentation of TEDD Phase I Findings to the Commissioners at their March 3, 2015 Regular Meeting

- BSED Presentation and Request to Take From the Table the Resolution of Necessity for Consideration of Action on April 21, 2015

Presentations to Billings City Council

TEDD Phase II

- Lockwood TEDD Project Plan and Schedule

- Lockwood TEDD Steering Committee

- Lockwood TEDD Public Meeting, March 23, 2016

- Lockwood TEDD Public Meeting, May 12, 2016

- Lockwood TEDD Public Meeting, October 3, 2016

- TEDD Boundary Option 1

- TEDD Boundary Option 2

- TEDD Boundary Option 3

- Zoning Jurisdiction Amendment Line - Updated 06/16

- 2016 Lockwood Growth Policy Adopted

Transcripts of Public Meetings as a Part of TEDD Phase I

- BOCC Discussion on January 12, 2015

- Utilities Working Group Meeting on January 12, 2015

- 1st Public Meeting on January 12, 2015

- 2nd Public Meeting on January 13, 2015

- Taxing Entities Meeting on January 13, 2015

- Utilities Working Group Meeting on February 12, 2015

- Taxing Entities Meeting on February 12, 2015

- 3rd Public Meeting on February 12, 2015

Taxes

- Tax Assessment Levy District Totals by Class Code

- Tax Levy Comparison for FY 2015 and FY 2014

- Proposed TEDD Tax Roll

Maps of Lockwood TEDD Study Area

- Proposed Lockwood TEDD Study Area as of April 1, 2015

- Consensus Building Map Featuring the Proposed TEDD and the Billings Bypass as of April 21, 2015

Media Coverage

Answers to Questions – Responses to Assertions

RFP